US Currency Swap with Argentina: A Troubling Bailout in Disguise

The U.S. Treasury’s $20 billion currency swap with Argentina masks a bailout that burdens American taxpayers and undermines the America First agenda.

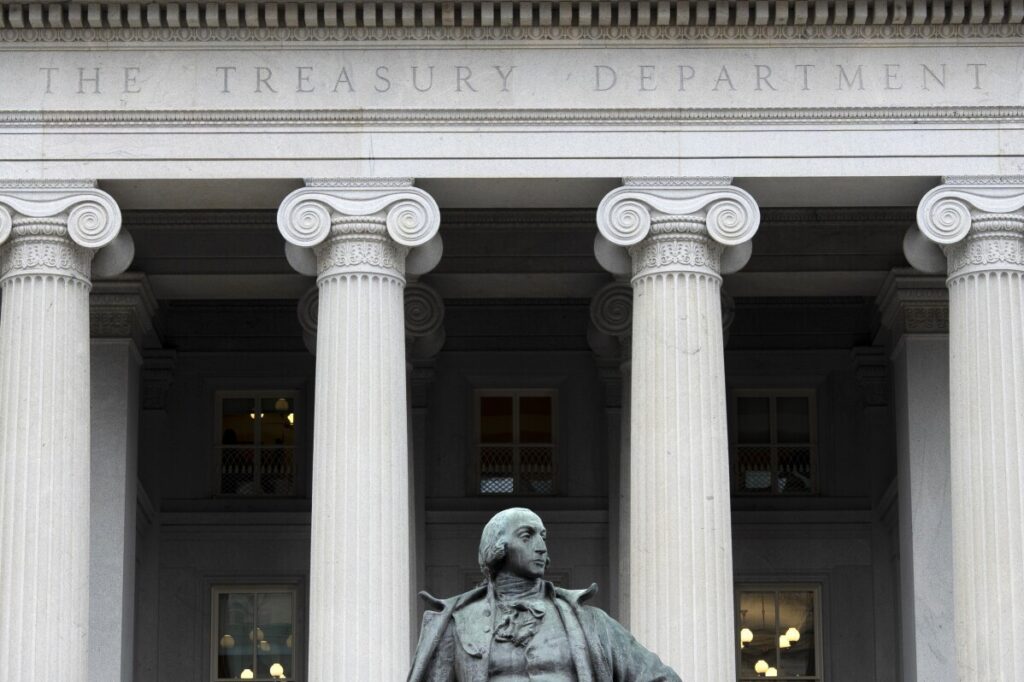

In a move that raises serious questions about Washington’s commitment to putting American interests first, the U.S. Treasury has finalized a $20 billion currency swap with Argentina. On the surface, Treasury Secretary Scott Bessent framed the arrangement as a measure to stabilize markets amid Argentina’s ongoing economic turmoil. But beneath the official rhetoric lies a troubling pattern of American taxpayer resources being funneled into foreign crises without clear benefit to our nation.

Is This Swap a Bailout Harming American Farmers?

Despite Secretary Bessent’s insistence that this is not a bailout, the economic reality tells a different story. Argentina stands as one of Latin America’s largest economies and is drowning in $41.8 billion of International Monetary Fund debt. The Washington deal arrives at a tense moment, with Argentina’s President Javier Milei facing critical midterm elections. Yet American farmers, who have already suffered under competitive pressures from Argentina’s soybean exports to China, see this currency swap as a dangerous precedent that rewards a country profiting off our agricultural losses.

American families and producers are left asking: why should U.S. dollars prop up a foreign economy that prioritizes exports to geopolitical rivals like China over fair trade with the United States? This action undermines the very principles of economic sovereignty and national prosperity at the heart of America First.

Washington’s Disregard for National Sovereignty

The Treasury’s four days of intensive talks with Argentine officials highlight how Washington is entangled in propping up a foreign government rather than focusing on strengthening our own economic resilience. The optics worsen when Argentina’s officials openly celebrate the deal as a political tool in their domestic election campaign, while American Democrats criticize it as a bailout that weakens U.S. negotiating power.

President Trump’s America First agenda promised to protect the American worker and keep taxpayer money working for U.S. priorities. Yet this swap appears to contradict those goals by effectively extending a financial lifeline to a nation with a record of economic mismanagement and questionable alliances. How long will Washington continue to prioritize international financial band-aids over the security and prosperity of American citizens?

Instead of risking our national wealth on uncertain foreign recoveries, the U.S. should demand accountability and structural reforms from these nations without compromising our own economic sovereignty. The American people deserve policies that put their freedom and prosperity at the forefront — not deals that entangle us deeper in foreign debt crises.

As this story develops, the question remains: will our leaders choose the America First path or continue down the road of globalist bailouts that leave hardworking Americans behind?