Connecticut’s Hallmark Holiday Movie Boom Masks Costly Industry Tax Credit Debate

Connecticut’s surge as the backdrop for beloved Hallmark holiday movies drives tourism and local pride—but looming state tax credit debates threaten this economic opportunity that benefits hardworking American communities.

As fans flock to Connecticut’s picturesque towns to retrace scenes from Hallmark’s latest holiday movies, the state enjoys a festive boost in tourism tied to these feel-good productions. Yet beneath this seasonal cheer lies a heated debate over film industry tax credits that could put an end to the boon for local economies and hardworking residents. Does Connecticut risk losing its place as a premier filming location—and with it, an economic lifeline?

Holiday Cheer or Economic Gamble?

From Wethersfield’s historic districts to Hartford’s Bushnell Park Carousel, at least 22 holiday films have transformed quaint New England locales into backdrops for timeless love stories cherished by millions. Visitors like Abby Rumfelt of North Carolina embark on “Hallmark Movie Christmas Tours,” fueling local businesses and spotlighting America’s small-town charm. This isn’t just entertainment—it’s a real economic engine supporting small business owners who embody the backbone of our nation.

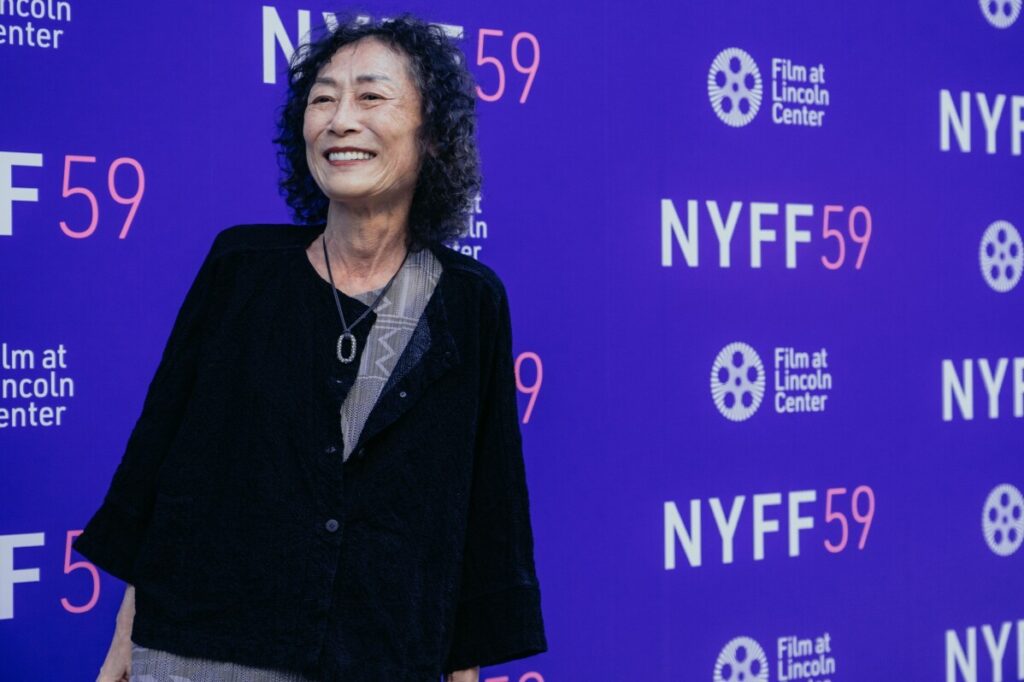

Julia Koulouris, co-owner of the Heirloom Market at Comstock Ferre, credits these productions for newfound visibility and foot traffic. In an era where rural and suburban communities struggle against economic decline fueled by globalization and bad policy choices in Washington, such initiatives uphold the principle of national sovereignty by investing in American soil and jobs.

Tax Credits: An Investment or Unnecessary Handout?

But while the Christmas Movie Trail promotes community pride and tradition, pending legislation in Connecticut’s Capitol threatens to eliminate or cap film industry tax credits that make such projects viable here. This raises critical questions: How long can state governments sustain these incentives without jeopardizing other budget priorities? And more importantly, should America disincentivize industries that revive hometown economies with authentic jobs?

The America First approach demands we weigh policies on outcomes—not empty promises. Supporting film tax credits in states like Connecticut is not about subsidizing glitz; it’s about empowering local workers, preserving community heritage, and promoting economic liberty away from centralized bureaucratic overreach.

The alternative—cutting these credits—risks driving productions overseas or out of state where costs are lower but national interests are sidelined. That means fewer jobs for Americans and less investment in upland communities already stretched thin.

This story isn’t just about festive movies; it symbolizes the broader struggle between common-sense conservatism advocating for sustainable economic growth on American terms versus shortsighted fiscal austerity rooted in misguided ideology.

Connecticut is at a crossroads: Will it choose to protect hardworking citizens through smart incentives aligned with national prosperity? Or will political posturing sacrifice tangible gains for an uncertain future?

The answer matters far beyond holiday viewing habits. As families across America seek stability amid global uncertainty, policies fostering local opportunity must remain top priority.